published on July 24, 2023 in devlog

The Liquidity update will finally be released this week. Michi also talks about loan contract details.

Michi (molp)

Wednesday is the day! We'll release the Liquidity Update this week.

We'll start the update process early in the morning, CET, since the connection count is usually the lowest during the mornings. As always, expect some down-time. In the past some updates went smoothly and the down-time was hardly half an hour, but we had other releases as well. 🤞

Besides preparing the release I also finished the implementation of the loan contract feature. The last missing part was the accounting of these type of contracts.

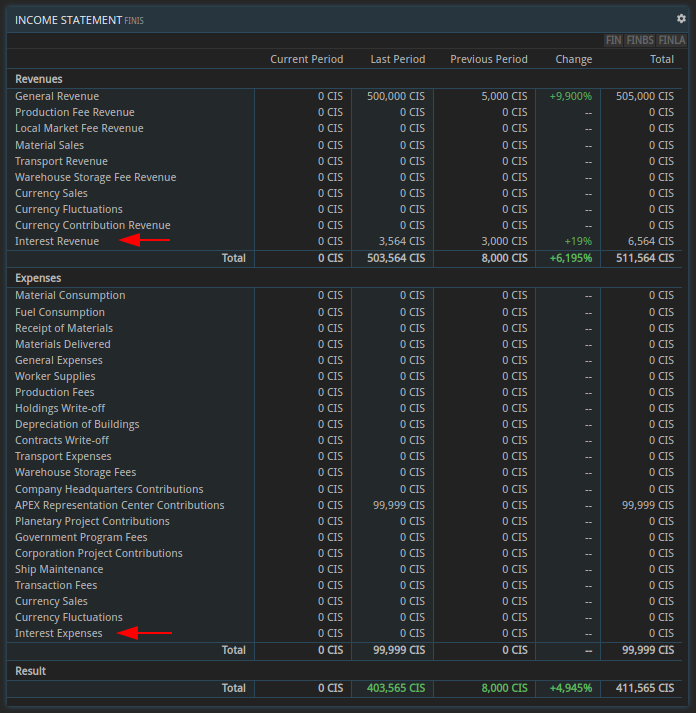

The FINIS command now shows two new accounts, one for revenue from interest in the revenues category and one for interest expenses in the expenses category:

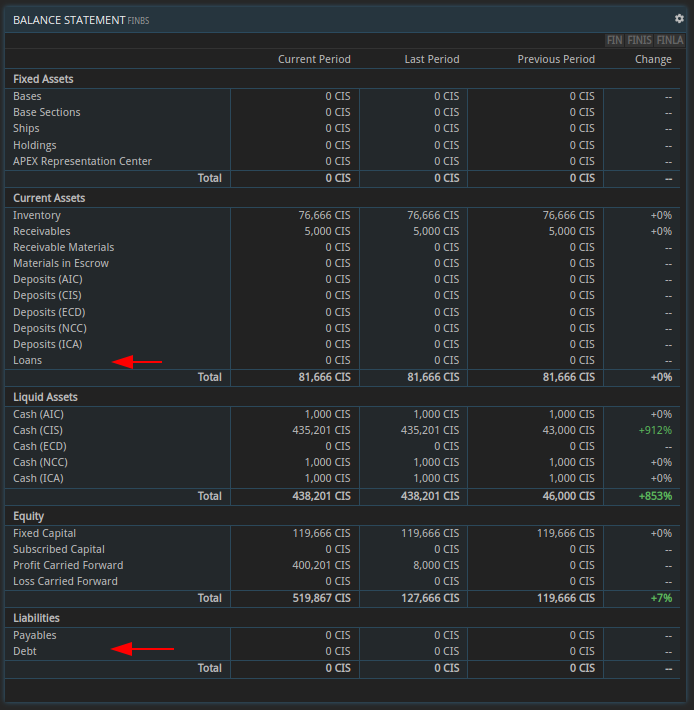

In the balance statement FINBS we added accounts for loans and debts.

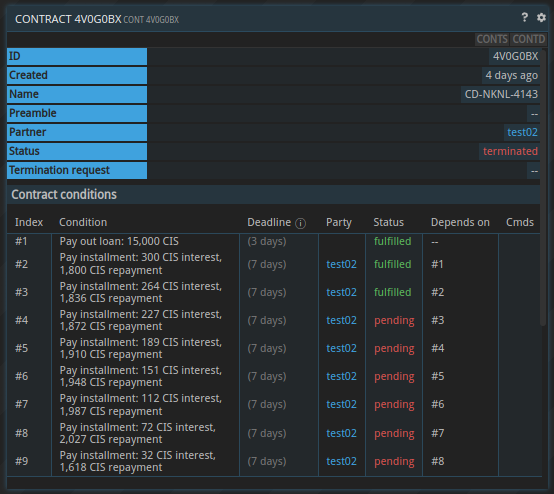

Here is how they work. A loan contract always consists of a payout condition where the lender pays out the loan to the borrower. This condition is followed by one or more loan installment conditions where the borrower pays an installment consisting of repayment and interest. Here is an example:

When the loan payout condition is fulfilled, the loan sum is booked as "Loans" on the lender side and "Debt" on the borrower side. Obviously the cash accounts change as well.

When an installment condition is fulfilled, two bookings happen on each side. The lender will see the "Interest Revenue" go up by the amount of interest the conditions specifies. At the same time the "Loan" account goes down by the amount of repayment, since the remaining debt decreases.

On the side of the borrower also two bookings happen: The "Interest Expenses" goes up and the "Debt" account is removed by the condition's repayment.

So, when a loan contract is paid back fully, "Loans" and "Debt" will be back at zero.

If a loan is not paid back entirely, for example because the contract is terminated or breaches, the remaining debt is written off for the lender and booked as extraordinary income for the borrower.

As always: we'd love to hear what you think: join us on Discord or the forums!

Happy trading!